25 provinces introduced special cost-reduction programs

Dec 28,2021

Since the beginning of this year, the State Council level has made multiple deployments on cost reduction measures such as tax cuts and fee reductions, various departments have also introduced a number of policies, and local level cost reduction programs have also been intensively introduced. According to preliminary statistics from a reporter from the Economic Information Daily, 25 provinces have already issued specific plans for "cost reduction". A series of measures will at least reduce the cost of enterprises by more than 700 billion yuan this year. The reporter learned that in the next step of the cost reduction policy reserve, tax reduction will continue to be the focus, and more measures including reducing the manufacturing value-added tax rate are being brewed.

Among the cost-cutting measures that have been introduced so far, tax reduction and fee reduction can be said to be the most powerful. The tax reduction scale of the VAT reform which was fully launched on May 1 alone is expected to reach 500 billion yuan, which is the biggest tax cut of the current government. In terms of fee reductions, after the State Council lowered the rates of three types of insurance in the five social insurance policies last year, this year, the social insurance premium rates and housing provident fund payment and deposit ratios were again reduced in stages. Preliminary estimates indicate that these measures can reduce the burden on enterprises by more than 100 billion yuan each year.

In addition, this year’s tax reduction and fee clearance measures include: starting from February 1st, a number of government fund fee items have been cleaned up and standardized, which is expected to reduce the burden of enterprises by about 26 billion yuan each year; from May 1st, 18 The scope of exemption of administrative and institutional charges; the two reductions in electricity prices can reduce the burden of electricity expenditures for industrial and commercial enterprises by about 47 billion yuan; from September 6, the bank card payment fee will be greatly reduced.

In addition, the “cost reduction” specific programs of each province also refer to high taxes and fees.

Among them, the "Supply-Side Structural Reform Cost Reduction Action Plan (2016-2018)" issued by Guangdong Province shows that the province is expected to reduce the tax burden cost for enterprises by more than 50% of the total scale of burden reduction. Shandong Province issued the "Opinions on Reducing the Tax Burden of Enterprises and Reducing the Cost of Financial Expenditure" in response to tax cuts. According to preliminary estimates, it can cumulatively reduce the burden of enterprises in the province by more than 200 billion yuan.

In fact, the voice of the business community has always been strong for further tax cuts, especially the value-added tax rate of the manufacturing industry. The 2015 National Corporate Burden Survey and Evaluation Report released by the China Small and Medium-sized Enterprise Development Promotion Center shows that the surveyed companies have the highest call for the introduction of a "tax reduction and exemption" policy, and the proportion of companies that reflect this request has reached 80%.

“The focus of reducing corporate tax burden is still on value-added tax,” Jiang Zhen, an associate researcher at the Institute of Financial and Economic Strategy of the Chinese Academy of Social Sciences, told the reporter of "Economic Information Daily" that corporate tax burden, especially the burden of turnover tax, has increased The difficulty of entrepreneurship and innovation is not conducive to the realization of the innovation-driven goals of the "13th Five-Year Plan".

He pointed out that after the "VAT reform", the next step is to deepen the VAT reform. Judging from the practical experience of international value-added tax, many countries have 1-2 tax rates, which is ideal. At present, my country's service industry and manufacturing industry have multiple tax rates, and there is a large gap between industries. Lowering the value-added tax rate, especially the value-added tax rate of the manufacturing industry, is undoubtedly a more appropriate way to reduce the tax burden of enterprises.

Li Quan, a researcher at the Chinese Academy of Fiscal Sciences, told reporters that after the implementation of the VAT reform policy, the value-added tax rate will implement a five-tier system (that is, 17%, 13%, 11%, 6%, 0), plus a 3% levy rate. Too many tax rates can easily lead to unsmooth VAT deductions, which may lead to new policy pressures and pressures on collection and management. Therefore, “considering that there are too many grades of value-added tax rates in our country, we must continue to consolidate these tax rates. Of course, the implementation time must be comprehensively considered based on the operating time and status of the value-added tax."

Yang Zhiyong, a researcher at the Institute of Financial Strategy of the Chinese Academy of Social Sciences, also pointed out that the ideal value-added tax rate should have only one basic tax rate. Taking into account the actual needs, the value-added tax rate can still choose a basic tax rate plus a low tax rate, and choose a reasonable tax exemption range. Based on the fact that the value-added tax rate in the Asia-Pacific region is relatively low, it is reasonable to set the basic tax rate at about 10% and the low tax rate at about 5%. The levy rate should also be set at only one level, set at about 3%.

China Construction Bank chief economist Huang Zhiling told the "Economic Information Daily" reporter that the main contradiction facing the Chinese economy is excess low-end production capacity and insufficient high-end production capacity. The macroeconomic policy goal is to strive to promote economic upgrading, especially industrial upgrading. Industrial upgrading is subject to technological progress, equipment technology, better materials, worker quality and labor skills, etc., which require a large amount of R&D investment, equipment update, and labor training. If policy formulation and operation deviate from the macro-intent of "cost reduction", and even drive companies to reduce necessary development expenditures to achieve immediate cost reduction effects, the result can only be to further solidify low-end production capacity, which runs counter to the goal of industrial upgrading.

In his view, the "cost reduction" as a central policy is to help companies reduce unreasonable cost burdens from the external environment, rather than requiring companies to reduce necessary costs. The core point for the government to help companies reduce costs is to play a "combined punch" in reducing institutional transaction costs, tax burdens, and logistics costs.

Recommended

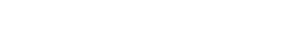

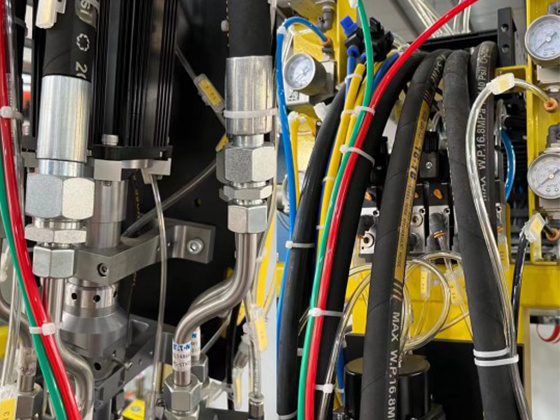

JIU LONG Secures U.S. MSHA Certification, Advancing Global Strategy